This is a perspective by Hunter Hummell. The Pilot welcomes perspectives, letters to the editor, and opinion articles from the whole community. Please submit to [email protected].

At some point in this past week you may have seen these three letters: GME. Yet, not many people – save avid stock traders – know what they stand for. GME is the official stock ticker of the company GameStop. For the past few weeks, GME stock has risen over 1500%, something rarely seen on the stock market. GameStop, through no work of its own, became a multi-billion dollar corporation in the space of a month going from being valued at under $1.3 billion to over $21 billion.

One explanation for this is that a team of ‘Redditors’ – users of the social media platform Reddit – have created a “pump and dump” Ponzi scheme for investors. However, this isn’t true, and the real story consists of Redditors being the heroes, not the villains.

Before several weeks ago, GameStop was one of the most shorted companies in recent U.S History. Hedge funds like Melvin Capital, a $13 billion fund, shorted roughly 100-152% of all shares available for trade. In other words, Melvin Capital was guessing that over a couple of months GameStop stock would decrease in value, so they sold borrowed shares, expecting to buy them back at a lower price.

In late 2020, Melvin Capital borrowed and sold shares of GameStop stock. Believing the price of the stock would decrease over time, traders thought they could buy all of the borrowed stock back at a lower cost. What they didn’t expect was for the price to go up – which it did, depriving hedge funds like Melvin Capital of millions of dollars in profit. Due to the price going up, Melvin Capital would have to cover their shorts by buying back borrowed stock on the day their short calls end and incur a large loss.

Around a month ago, Melvin Capital shorted the stock to around $11, which meant that if GME shares were below $11, by Friday, Jan. 29, 2020, and into the following week they would stand to make an unbelievable profit. Well, it was a bad bet.

Melvin capital had confidently over-shorted the company. Enter r/Wallstreetbets, a Reddit community focused on taking high risk in the stock market. Come January 20, 2020, r/Wallstreetbets had bought enough stock to raise the price to $40 a share.

Thinking the worst was behind them, Melvin Capital decided that if they doubled down on their shorts at a slightly higher price, they could still recoup the losses. The battle between retail investors and hedge funds had begun.

Smelling blood in the water, r/Wallstreetbets began pouring their life savings into the stock. This drew public attention. Elon Musk tweeted one simple word “Gamestonk.” Soon numerous VIP’s such as Dave Portnoy, Mark Cuban, and Kevin O’Leary jumped onto the side of retailers. With the support of these millionaire investors, the stock price soared to over $300 a share. The hedge funds then chose a new route.

On Wednesday, Jan. 27, 2020, Melvin Capital’s spokesperson went on CNBC and said that they had closed their short positions the day before. This meant that Melvin Capital had no more shares they had to buy back and that the stock would be essentially worthless. The stock only held that value because there was a guarantee that Melvin Capital and some other shorters had to buy out over 100% of the tradable shares.

r/Wallstreebets had guaranteed a short squeeze, and if Melvin Capital did close their positions, r/Wallstreetbets may be the ones left holding the losses. So far Melvin Capital has offered no evidence that they actually closed their positions.

The entire assumption of people buying GME is that they believe that Melvin Capital closed very few positions, if any. The thought is that on Jan. 27, 2020 that statement was made to mislead shareholders and drop the price. On that same day, r/Wallstreetbets was taken off Reddit and banned from Discord.

Furthermore, Robinhood, an investment app consisting of only retail investors, announced that they stopped anyone from buying GME stock. Robinhood customers owned more than 50% of the tradable GME stock and were instrumental to raising the stock price. The entire customer base was banned from buying any more GME. Robinhood received 40% of its funding from Citadel, a company with billions of dollars invested in Melvin Capital. This move caused the stock to drop over $100 per share. Those who used other brokerages were also hindered from buying the stock due to market halting. The market was halted five times throughout the day, yet hedge funds were still allowed to trade GME during these periods.

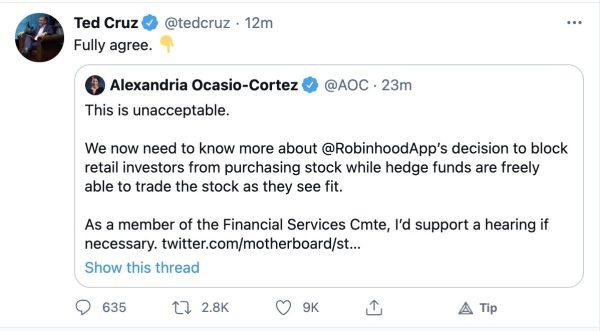

Immediatelym politicians jumped behind the retail investors. It’s been a long time since we have seen bipartisan support for anything, but on that Wednesday, Rep. Alexandria Ocasio-Cortez (D-NY), Donald Trump Jr, Sen. Ted Cruz (R-TX), Sen. Elizabeth Warren (D-MA), and Ben Shapiro all independently agreed to the same thing; the era of a market imbalance should be over.

Congressional hearings for Robinhood immediately went into the works. Numerous lawsuits were filed against any brokerage that stopped the buying of GME. The U.S. Security and Exchange Commission’s lack of involvement received immediate backlash from senators like Warren.

This public support resurrected r/Wallstreetbets and it was finally allowed back on Reddit. This caused people to buy GME not because they wanted to make money but because they had the power to make Wall Street bleed, so to speak. Melvin Capital and the rest of the Wall Street hedge funds made a mistake by thinking they could manipulate the market scotch free. Their sloppy calls are costing them billions of dollars and returning money to those who need it most.

Over the past week GME stock fluctuated quite a bit. You may be wondering how the stock price is going down if more people are willing to buy it. The truth is, at this point most people have already bought GME stock and their sole job is not to sell it. The longer they hold the higher the price goes. The Reddit group r/Wallstreetbets argues that when you see the price go down it is not the actual value of the stock, but market manipulation.

If certain investors and r/Wallstreetbets are right, Melvin Capital and other shorters will be forced to buy these shares back. As soon as retail investors start selling, the sooner the short squeeze happens. Theoretically, if nobody sold their shares at the market price, the retail investors could name any price they wanted. This is because Melvin Capital is contractually obligated to buy these shares at whatever price people are willing to sell them.

If you ever go to r/Wallstreetbets, you will see the terms “Diamond Hand’s” and “GME to the Moon.” These Redditors are willing to wait as long as possible to raise the price to a devastating effect. With the first round of shorts expired on Jan. 29, everybody was waiting to see if Melvin Capital was going to start buying back and whether the retail investors would sell their stocks, neither of which happened.

On Jan. 29, 45 million shares were traded, and on Jan. 27 and Jan. 26, 157 million trades were traded. It looks as if these r/Wallstreetbet guys do have diamond hands. Nobody knows when the short squeeze will happen or if it even will happen, but if the retail investors can hold the line, they could potentially be looking at a serious profit, and Melvin Capital could be on its way to bankruptcy, already having suffered a reported 53% loss on its investments.

In the famous words of a fellow r/Wallstreetbet boy, “I know this GameStop stuff is funny, but you have to remember this is hurting real people who own multiple boats.”

Featured photo by Maxim Hopman on Unsplash.